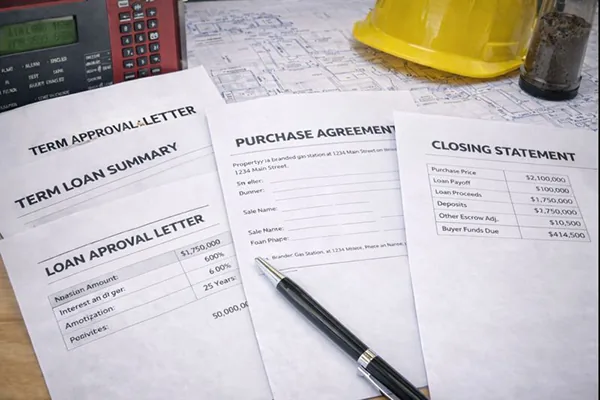

Finance-Friendly Fuel Assets

Debt, equity, and tax-deferred strategies built for fuel assets.

Connect with lenders who understand gas stations, C-stores, and truck stops.

Quick links: Buy · Buyer Intake · Sell · Off‑Market · How We Work · FAQ · Contact

Popular buyer searches

These pages are built around the most common ways buyers search for fuel and convenience assets:

- Gas station for sale

- Gas stations for sale

- Gas station business for sale

- Convenience store for sale

- C store for sale

- Gas station with car wash for sale

- Branded gas station for sale

- Gas station business only for sale

- Gas station for sale with real estate

- Truck stop for sale

- 1031 exchange gas station

- NNN net lease gas station

Lenders Who Know Fuel

Not every lender is comfortable with fuel assets. We maintain relationships with banks, credit unions, and private capital sources that understand gallons, environmental, and brand factors.

- Conventional, SBA, and bridge solutions.

- Refinance, acquisition, and construction options.

- Guidance on lender expectations and underwriting materials.

Prepare Your Package

We can help coordinate the information lenders will ask for so that your file moves faster: historical P&L, fuel volume reports, store sales, and lease structures.

Frequently Asked Questions

What down payment is typical for gas stations and C-stores?

It varies by lender and deal strength, but many buyers plan for a meaningful equity contribution plus working capital. We’ll point you to the right lender profile based on your deal type.

Can SBA loans be used for gas stations?

Sometimes—eligibility depends on structure, financials, and the specific business model. We can help you package the request and choose the right lending channel.

What documents will lenders ask for?

Typically: personal financial statement, tax returns, business financials/P&L, rent or mortgage terms, fuel supply details, and a purchase contract/LOI.

Do lenders care about environmental issues?

Yes. Many require Phase I (and sometimes Phase II) environmental reports. Addressing environmental risk early can prevent financing delays.

How long does financing usually take?

If documents are ready, timelines are often measured in weeks—not days. Deal complexity and third‑party reports (environmental, appraisals) can add time.

Can you connect me with multiple lender options?

Yes. We can introduce you to financing partners based on your target price, geography, and whether it’s real estate included or business-only.

Common questions

What financing is common for gas stations?

SBA (when eligible), conventional bank loans, and private/bridge capital depending on deal structure, brand, and borrower profile.

Can the business cash flow support the debt?

That’s the core question. We look at verified financials, fuel volume trends, inside sales, and rent/debt coverage to assess supportability.

Do lenders require environmental reports?

Often yes. Requirements vary, but Phase I ESA and brand/UST compliance items are common diligence steps.

What down payment is typical?

It varies by lender and structure, but plan for meaningful equity—especially for first-time buyers or higher-risk sites.

Do you work with buyers using 1031 funds?

Yes. We help align timing, diligence, and closing requirements with 1031 deadlines.

Related resources

Quick links to key pages visitors usually want next: