New: National Gas Station Market Report (buyer demand, deal structures, diligence, financing, and metro guides).

Sell Your Gas Station Confidentially

Quick answer: We help gas station owners sell with control and confidentiality—quiet outreach first, qualified buyers only, and a clear path from valuation to closing. Exact locations and sensitive details are shared only after qualification (and NDA when appropriate).

If you’re preparing a gas station business for sale (real estate + business, business-only, or branded), we help you control disclosure, qualify buyers, and close cleanly.

Confidential guidance from valuation through closing.

Get a confidential value range and an exit plan. We can run quiet outreach to qualified buyers—or go broader—only when you approve the strategy and materials.

Quick links: Buy · Buyer Intake · Sell · Off‑Market · How We Work · FAQ · Contact

Popular buyer searches

These pages are built around the most common ways buyers search for fuel and convenience assets:

- Gas station for sale

- Gas stations for sale

- Gas station business for sale

- Convenience store for sale

- C store for sale

- Gas station with car wash for sale

- Branded gas station for sale

- Gas station business only for sale

- Gas station for sale with real estate

- Truck stop for sale

- 1031 exchange gas station

- NNN net lease gas station

- More high-intent buyer searches

- Gas Station For Sale Seller Financing

- Gas Station Leasehold For Sale

- Gas Station Ground Lease

- Sale Leaseback Gas Station

- Gas Station For Sale With Diesel

- Gas Station For Sale Highway

- Gas Station For Sale Interstate

- Turnkey Gas Station For Sale

- Small Gas Station For Sale

- Gas Station For Sale With Convenience Store

- Gas Station Valuation

- How To Sell A Gas Station

- Top metros we cover

- Gas Station For Sale Dallas

- Gas Station For Sale Houston

- Gas Station For Sale Atlanta

- Gas Station For Sale Phoenix

- Gas Station For Sale Miami

- Gas Station For Sale Tampa

- Gas Station For Sale Orlando

- Gas Station For Sale Charlotte

- Gas Station For Sale Los Angeles

- Gas Station For Sale New York

Seller representation built for clean closings

Selling a fuel asset is not the same as selling a generic retail building. We understand gallons, margins, brand contracts, environmental, lease structures, and operator sensitivities — and we speak the language of your buyers.

- Confidential Opinion of Value incorporating fuel, store, and real estate components.

- Marketing prepared specifically for fuel buyers, not generalist investors.

- Targeted outreach to known operators, family offices, and fuel-focused capital.

- Ability to run broad national exposure or tight, confidential processes.

- Strategic structuring: sale-leaseback, partial portfolio sale, or full exit.

Want the full process? See How We Work. If discretion matters, review Off‑Market (seller privacy rules apply).

Request a Confidential Seller Strategy Call

Seller readiness checklist

- Deal structure: real estate + business, business-only, ground lease, or sale-leaseback

- Financials: last 12–24 months inside sales, fuel volumes, and margin trends

- Docs ready: fuel supply agreement, leases (if any), equipment list, and permits

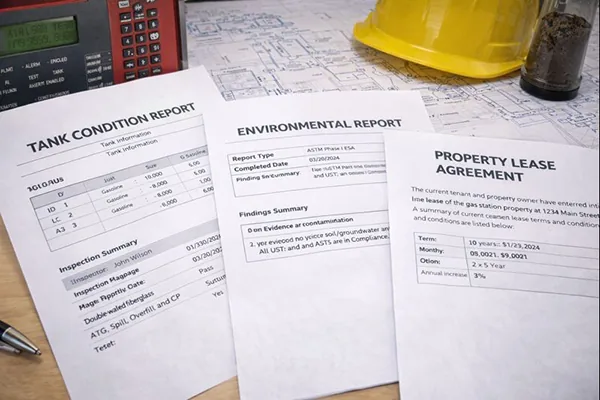

- Environmental: UST records, prior reports, and any known issues disclosed early

- Operations snapshot: staffing model, hours, key vendors, and major expense drivers

- Exit goals: target price range, timeline, and how public you want marketing to be

Seller readiness checklist

- Deal structure: real estate + business, business-only, ground lease, or sale-leaseback

- Financials: last 12–24 months inside sales, fuel volumes, and margin trends

- Licenses & compliance: permits, inspections, and any open items

- Environmental: UST records, prior reports, and known issues (if any)

- Operations: staffing, hours, vendor contracts, POS and inventory controls

- Real estate: survey/title basics, easements/access, and any planned improvements

- Marketing plan: quiet first (confidential) vs broader release (with your approval)

Tip: see the due diligence overview for the items buyers and lenders will ask for.

Seller readiness checklist

- Deal structure: real estate + business, business-only, ground lease, or sale-leaseback

- Financials: last 12–24 months inside sales, fuel volumes, and margin trends

- Licenses & compliance: permits, inspections, and any open issues

- Environmental: UST records, prior reports, and known issues (if any)

- Operations: fuel supply agreement basics, key vendor contracts, staffing notes

- What’s confidential: confirm what can be shared pre-qualification vs post-NDA

Seller readiness checklist

- Deal structure: real estate + business, business-only, ground lease, or sale-leaseback

- Financials: last 12–24 months inside sales, fuel volumes, margin trends

- Licenses & compliance: permits, inspections, and any open issues

- Environmental: UST records, prior reports, known issues (if any)

- Lease/real estate docs: rent schedule, options, estoppels, assignments (if leased)

- Operations: staffing plan, vendor contracts, maintenance log

- Confidentiality plan: what can be marketed broadly vs shared after qualification

Tip: If you’re unsure what applies, start with the basics and we’ll fill gaps during preparation.

Seller readiness checklist

- Deal structure: real estate + business, business-only, ground lease, or sale-leaseback

- Financials: last 12–24 months inside sales, fuel volumes, margin trends

- Licenses & compliance: permits, inspections, and any open issues

- Environmental: UST records, prior reports, known issues (if any)

- Lease/real estate docs: leases, rent schedule, options, surveys, title info

- Operations plan: staffing/manager setup, transition expectations

- Confidentiality plan: what can be shared before buyer qualification

Tip: buyers move faster when the story and documents are organized from day one.

What you get

- Curated matches based on your criteria (not mass emails)

- Clear pricing + deal structure notes

- Fast next steps when a deal fits

What we need

- Target market(s) and budget range

- Timeline and preferred deal type

- Best way to reach you

What happens next

- Quick call to confirm fit

- We send a short list of qualified opportunities

- We coordinate diligence and closing support

Confidential. No public blast unless you approve.

Seller Deal Experience (Anonymized Examples)

We represent sellers nationwide and run a controlled process that protects confidentiality, supports pricing, and drives closable outcomes. Here are a few anonymized seller-side examples—kept intentionally general.

- Major Metro (Confidential Sale): Pre-qualified buyers only, staged release of location/financials, and a structured offer window to strengthen terms—not just price.

- High-Traffic Submarket (Reposition + Relaunch): Reset pricing expectations, tightened the story (traffic, inside sales, upside), and reduced “deal drift” with clear milestones.

- Operationally Sensitive Site (Quiet Transfer): Managed NDAs, limited on-site exposure, coordinated access carefully, and kept the business stable through closing.

Want seller-side examples closest to your market? Tell us your area and price range and we’ll outline what we’re seeing right now.

Confidentiality First

- No public blast unless you approve: quiet outreach or broader marketing—your choice.

- Controlled disclosures: exact location and sensitive details shared after buyer qualification.

- Fewer unqualified inquiries: proof of funds and realistic timelines required before access is granted.

How It Works

- Quick intake: goals, timing, and confidentiality level.

- Value range + positioning: quiet or on-market strategy.

- Targeted buyer outreach: curated buyer list + offer coordination.

- Execution through close: financing/1031 timing, milestones, and clean handoff.

Why Use a Broker (Not Just a Listing Site)

- Quality over noise: we prioritize qualified parties and executable deals—not page views.

- Off-market capability: many sellers prefer privacy and never publish publicly.

- Execution control: pricing guidance, deal structure, and timeline discipline reduce failed closings.

Frequently Asked Questions (View full FAQ)

How do I sell confidentially without blasting my business publicly?

We can start with a confidential value range and a controlled buyer outreach. Nothing is publicly marketed unless you approve the strategy and materials.

What information do you need to price a gas station correctly?

At minimum: trailing 12 months sales (inside + fuel), gallons, margin, rent/loan terms, payroll, and major expenses. If you have tax returns and POS reports, pricing becomes much more accurate.

Do you work with leasehold (business-only) sellers?

Yes. We can market leaseholds, assignment opportunities, or negotiate new lease terms with qualified buyers.

How do you pre-qualify buyers?

We confirm proof of funds, lender readiness, and operational fit. Serious buyers also understand environmental diligence and inventory/working capital norms.

Will you help me with an exit plan and timeline?

Yes. We build a timeline around your goals—fast close vs maximum price, employee considerations, transition support, and confidentiality level.

What does the process look like after a buyer is found?

Offer → LOI → due diligence (financials, environmental, lease) → purchase agreement → closing. We help keep the deal moving and reduce retrades.

Related resources

Quick links to key pages visitors usually want next: